LTC SYSTEM

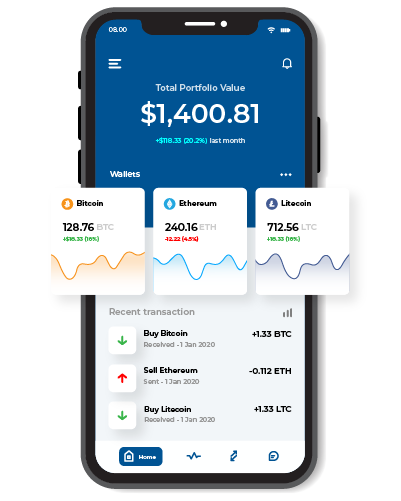

A contract for difference (CFD) is a contract between a buyer and a seller that stipulates that the buyer must pay the seller the difference between the current value of an asset and its value at contract time. CFDs allow traders and investors an opportunity to profit from price movement without owning the underlying assets. The value of a CFD contract does not consider the asset's underlying value: only the price change between the trade entry and exit. This is accomplished through a contract between client and broker and does not utilize any stock, forex, commodity, or futures exchange. Trading CFDs offers several major advantages that have increased the instruments' enormous popularity in the past decade.

Key Takeaways

A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes.

A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset.

Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short.

A disadvantage of CFDs is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD.

Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin.

How CFDs Work

A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities or derivatives) between the time the contract opens and closes. It is an advanced trading strategy that is utilized by experienced traders only. There is no delivery of physical goods or securities with CFDs. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down. Essentially, investors can use CFDs to make bets about whether or not the price of the underlying asset or security will rise or fall. Traders can bet on either upward or downward movement. If the trader that has purchased a CFD sees the asset's price increase, they will offer their holding for sale. The net difference between the purchase price and the sale price are netted together. The net difference representing the gain from the trades is settled through the investor's brokerage account. On the other hand, if the trader believes that the asset's value will decline, an opening sell position can be placed. In order to close the position, the trader must purchase an offsetting trade. Then, the net difference of the loss is cash-settled through their account.

News

How to Trade Decentralized Perpetual Swaps on MCDEX

Learn what perpetual swaps are and how to trade these crypto derivatives on MCDEX...

What is the Metaverse? What Role Will NFTs Play In It?

Ever heard of the metaverse? The term has been thrown around a...

Ethereum’s (Remaining) Journey to Ethereum 2.0

Ethereum’s long and arduous journey towards Ethereum 2.0 is slated to successfully end in 2022...